112

Hong Kong Cyberport Management Company Limited

Annual Report 2014/15

Notes to the Financial Statements

財務報表附註

Page 112

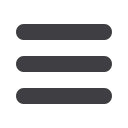

11 Loss before taxation

Loss before taxation is stated after crediting and charging

the following:

11

除稅前虧損

除稅前虧損已計入及扣除下列項目:

Crediting:

Rental income less outgoings of

HK$11,496,769 (2014:

HK$12,249,990)

Reversal of provision for impairment

of receivables

2015

HK$

港元

已計入項目:

租金收入扣除開支

11,496,769

港元

(

2014

年:

12,249,990

港元)

184,907,644

應收賬款減值撥備

回撥

562,464

2014

HK$

港元

176,044,366

1,867,683

Charging:

已扣除項目:

Cost of inventories

存貨成本

Auditor’s remuneration

核數師酬金

Provision for impairment of receivables

應收賬款減值撥備

Loss on disposals of property, plant

出售物業、機器及設備之

and equipment, net

虧損淨額

Finance cost:

財務費用:

Finance charges on obligations

融資租賃承擔之財務支出

under a finance lease

15,315,919

418,000

682,916

77,441

28,190

15,282,094

405,000

991,006

265,485

–

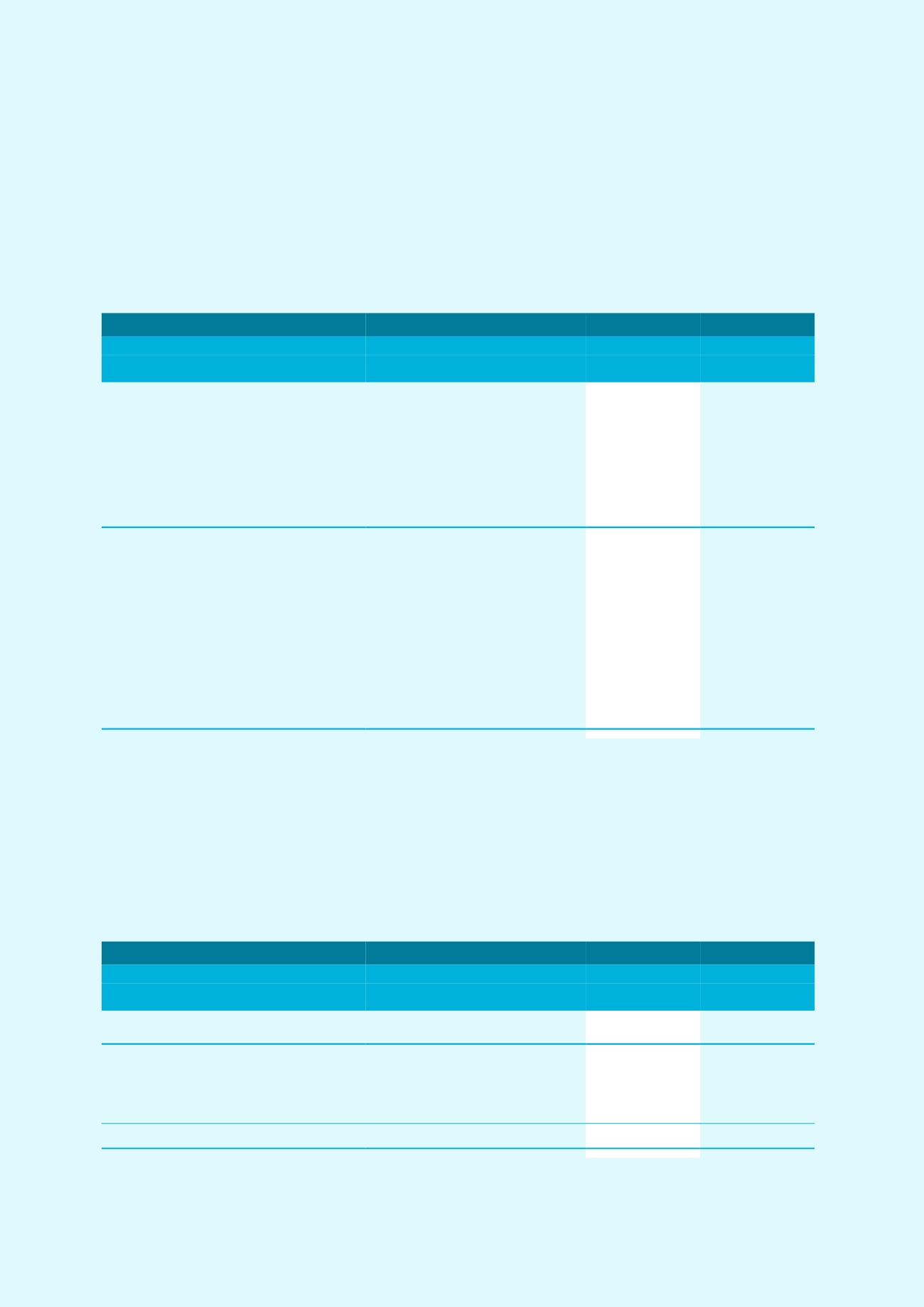

12 Income tax expense

(a)

No Hong Kong profits tax has been provided as the

Company has no assessable profits for the year (2014:

Nil).

(b)

The tax on the Company’s loss before taxation differs

from the theoretical amount that would arise using the tax

rate of Hong Kong as follows:

2015

2014

HK$

港元

HK$

港元

Loss before taxation

除稅前虧損

(57,582,934)

(81,825,225)

Calculated at a tax rate of 16.5%

(2014: 16.5%)

Income not subject to tax

Tax losses not recognised

按稅率

16.5%

(

2014

年:

16.5%

)計算之稅項

毋須課稅之收入

未確認之稅項虧損

(9,501,184)

(36,000)

9,537,184

(13,501,162)

(702,475)

14,203,637

–

–

12

所得稅支出

(a)

本公司本年度因無任何應課稅溢利,因此

並無就香港利得稅作出撥備(

2014

年:

無)。

(b)

本公司除稅前虧損之稅項與採用香港適用

稅率計算之理論稅額之差額如下: