Hong Kong Cyberport Management Company Limited

Annual Report 2014/15

118

Notes to the Financial Statements

財務報表附註

Page 118

15 Trade and other receivables

(continued)

All prepayments, deposits and other receivables are

expected to be recovered or recognised as expenses by

the Company within one year, except for the amount of

HK$1,550,073 (2014: HK$3,195,124) which is expected to

be recovered after one year.

(a) The carrying amounts of trade and other receivables

approximate their fair values and are denominated

in Hong Kong dollars.

(b) The credit terms given to the customers range from

0–30 days.

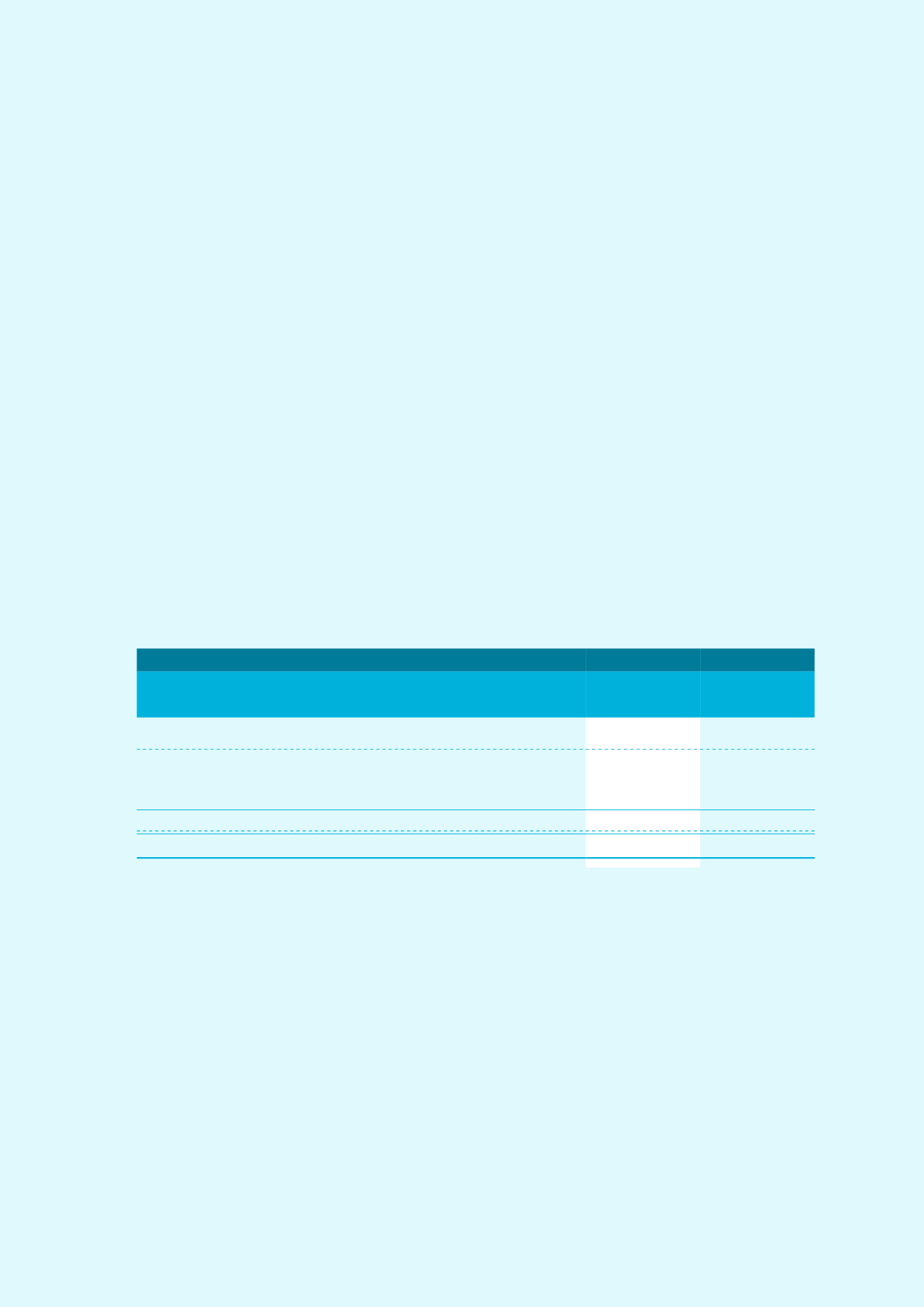

(c) As a t 31 Ma r ch 2015 , t r ade r ece i vab l es o f

HK$3,080,121 (2014: HK$3,902,868) were past due

but not impaired. These relate to a number of

independent customers for whom there is no recent

history of default. The aging analysis of these trade

receivables and net of provision for impairment is as

follows:

15

應收賬款及其他應收款項

(續)

除了為數

1,550,073

港元(

2014

年:

3,195,124

港元)之款項預計於一年後收回外,本公司

所有預付款項、按金和其他應收款項預期

可於一年內收回或確認為支出。

(a)

應收賬款及其他應收款項之賬面值

均與其公允價值相若,並以港元為

單位。

(b)

給予客戶之信貸期為

0

至

30

天。

(c)

於

2015

年

3

月

31

日, 應 收 賬 款

3,080,121

港元(

2014

年:

3,902,868

港元)已逾期但並無減值。該等款項

涉及若干近期並無違約記錄之獨立

客戶。該等應收賬款及已扣除減值

撥備之賬齡分析如下:

2015

2014

HK$

HK$

港元

港元

Neither past due nor impaired

未逾期亦無減值

2,000,996

4,291,134

Less than one month past due

逾期少於

1

個月

2,724,597

2,450,509

One to three months past due

逾期

1–3

個月

321,625

731,595

Over three months past due

逾期

3

個月以上

33,899

720,764

3,080,121

3,902,868

5,081,117

8,194,002

(d) The Company has assessed i f there i s any

impairment on an individual customer basis based

on aging analysis of trade receivables balance,

historical bad debt rates, repayment patterns,

customer credit worthiness and industry trend

analysis. As at 31 March 2015, the amount of the

provision for impairment of trade receivables was

HK$1,421,649 (2014: HK$4,869,891).

(d)

本公司根據應收賬款結餘之賬齡分

析、過往壞賬率、還款方式、客戶信

譽及行業趨勢分析以評估是否有個

別客戶出現減值。於

2015

年

3

月

31

日, 應 收 賬 款 之 減 值 撥 備 為

1,421,649

港元(

2014

年:

4,869,891

港元)。