香港數碼港管理有限公司

年報

2014/15

113

Notes to the Financial Statements

財務報表附註

Page 113

12 Income tax expense

(continued)

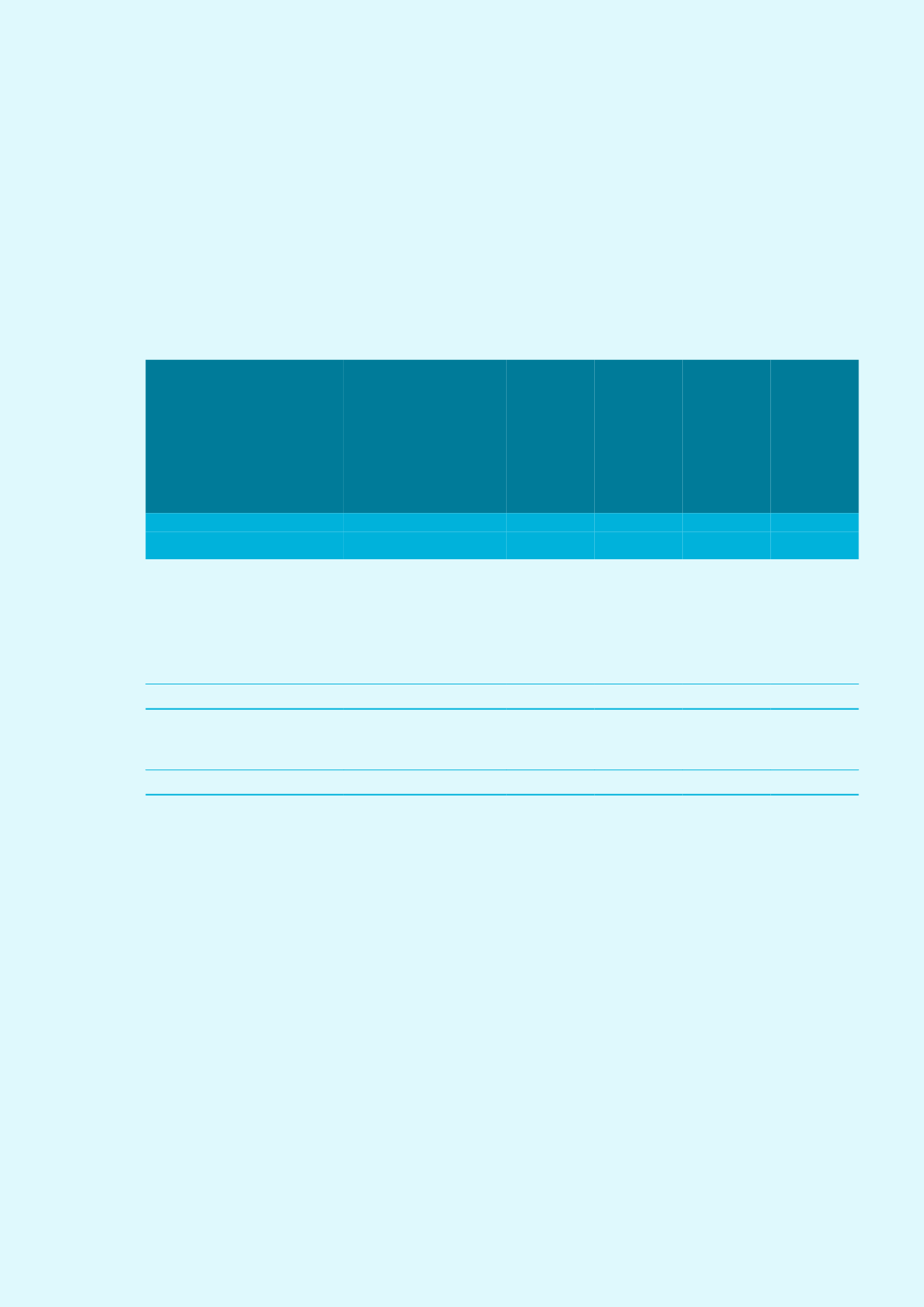

(c) Deferred income tax (assets)/liabilities

recognised

The movements of deferred income tax (assets)/liabilities

during the year are as follows:

12

所得稅支出

(續)

(c)

已確認之遞延所得稅(資產)╱負債

遞延所得稅(資產)╱負債於年內之變動如

下:

Depreciation

allowance in

excess of

related

depreciation

超出有關

Tax losses

折舊之折舊

Others

Total

稅項虧損 免稅額 其他 合計

HK$

HK$

HK$

HK$

港元 港元 港元 港元

Deferred income tax arising

遞延所得稅來自:

from:

At 1 April 2013

於

2013

年

4

月

1

日

(39,842,320) 40,925,120 (1,082,800)

–

(Credited)/charged to profit

於損益內(計入)╱扣除

or loss

(10,820,225) 10,540,957 279,268

–

At 31 March 2014

於

2014

年

3

月

31

日

(50,662,545) 51,466,077 (803,532)

–

At 1 April 2014

於

2014

年

4

月

1

日

(50,662,545) 51,466,077 (803,532)

–

(Credited)/charged to profit

於損益內(計入)╱扣除

or loss

(13,340,843) 12,771,883 568,960

–

At 31 March 2015

於

2015

年

3

月

31

日

(64,003,388) 64,237,960 (234,572)

–

(d)

Deferred income tax assets are not recognised for

remaining temporary differences arising from tax losses

carried forward due to uncertainty of realisation of the

related tax benefit through the future taxable profits. As at

31 March 2015, the Company has unrecognised tax losses

of HK$1,973 million (2014: HK$1,920 million). The tax

losses have no expiry date and are yet to be agreed by the

Inland Revenue Department.

(d)

由於無法確定能否透過未來應課稅溢利變

現相關稅項利益,故不就滾存稅項虧損所

產生之剩餘暫時差異確認遞延所得稅資

產。截至

2015

年

3

月

31

日,本公司擁有

未予確認之稅項虧損

19.73

億港元(

2014

年:

19.20

億港元)。稅項虧損並無限期,

但須待稅務局確認。